Release Notes

July 2024 Release

New Features

Leverage trading: Leverage trading is now available to U.S. Eligible Contract Participants and all international Figure Markets members. You can access up to 4x leverage on your eligible assets (BTC, ETH, USD, and HASH1). Meaning, $1 of collateral can be used to take out a loan of $4.

Make sure you monitor your account loan-to-value (LTV) ratio to avoid liquidation events:

-

You can borrow up to a maximum of 80% account LTV. For example, if your account value is $10,000 before loans, you can take out a loan of up to $40,000. Your total account value would then be $50,000 with a LTV ratio of 80% LTV.

-

If your account LTV rises to 85% (your account value drops below $42,500), you’ll receive an email and push notification alerting you to adjust your positions or add funds to prevent a liquidation event.

-

At 90% LTV, our system will sell assets on your behalf to reduce your account LTV to 80%.

Decentralized multiparty computation (MPC) custody: To provide enhanced security and resiliency against unauthorized transactions, we’ve added MPC hosts to our custody solution. You can learn more about how Figure Markets leverages MPC technology for decentralized custody on our whitepaper.

Figure Markets investments page: Figure Markets members can explore new investment opportunities like SOL SPV (closed) and Figure REIT in a single place. More investment opportunities are coming soon, with the Liquid Real World Asset fund being launched later in August. Members can enjoy a new navigation with dedicated sections for Trade, Invest, and Borrow. You can visit the new investments page here.

Improvements

Reduced crypto withdrawal processing time: We have significantly reduced crypto withdrawal processing times. Most withdrawals are now processed in minutes and then dispatched onto the relevant blockchains for distribution to your external crypto address.

Improved liquidity: We've been working with partners to enhance liquidity and bring you better pricing. As a result, you’ll see tighter bid-ask spreads across multiple trading pairs.

Bugs and Fixes

We’ve made general bug fixes and UX improvements to the mobile app experience.

1 The collateralizable value of HASH holdings is at 40% of the market rate.

June 2024 Release

New Features

Figure Markets app: We're excited to announce the release of our new Figure Markets app.

-

Mobile-first, integrated KYC: Apply for and verify your identity directly within the app

-

Seamless integration: Connect to Figuremarkets.com for a unified trading experience

-

Enhanced asset details: Gain deeper insights into your assets and transaction history directly from the app

All users are required to download the Figure Markets app and import their existing Figure wallet (if you have one). Don't worry, the process is quite straightforward! Check out our import guide and FAQs here.

Improvements

-

24/7 BTC/ETH liquidity so prices better track with general crypto currency pricing

-

Moved the exchange from figure.com to figuremarkets.com

-

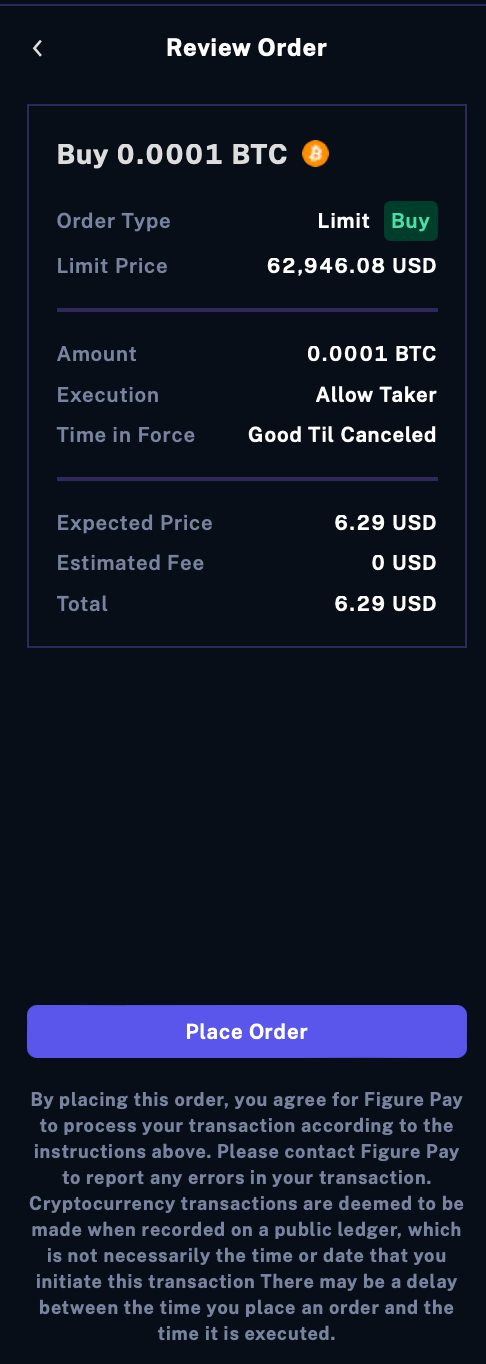

Added order confirmation screen to verify details before placing orders

-

Implemented a new side-by-side order book layout for a clearer view of buy and sell orders

-

Changed chart view for periods of no trading activity. Users will now see a flat line on the chart instead of no data

-

Lowered USDC deposit requirements to 10 USDC

-

Increased session time so users can stay logged in for 12 hours without needing to re-authenticate

-

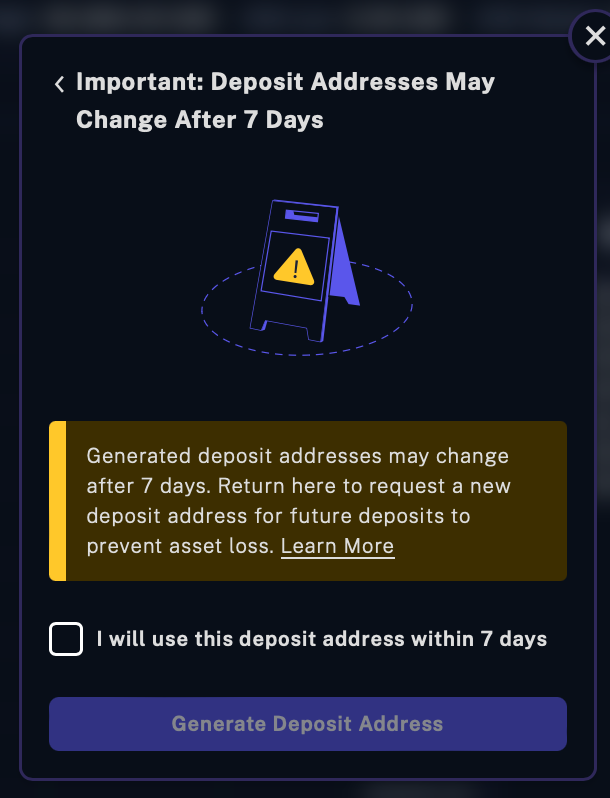

Added a reminder within the deposit workflow to indicate that the user address may refresh in seven days. Make sure to request a new deposit address before they expire