Why Figure Markets: Experience the best of DeFi and TradFi

By Figure Markets Team

November 11, 2024

The collapse of traditional centralized exchanges like FTX has exposed the risks of traditional custodial models, where users often give full control of their assets to the platform without realizing the potential vulnerabilities. These can include a lack of transparency in how funds are managed, the possibility of mismanagement or fraud, and the risk of the platform failing. Many traders remain unaware of these vulnerabilities, assuming their assets are safe, only to find them at risk when the platform suddenly collapses and they lose their funds.

This situation has led to a growing demand for secure and reliable solutions. Traders and investors are now seeking platforms that offer greater control, transparency, and trust. Figure Markets addresses these vulnerabilities by offering a decentralized custody model powered by Multi-Party Computation (MPC) technology and self-custody wallets. By combining this approach with other features like crypto-backed loans and daily-yield opportunities, Figure Markets delivers the best of TradFi and DeFi, all in one platform.

In this article we will explore:

- Decentralized custody model

- Daily-yield opportunities

- Crypto-backed loans

- Future expansion into traditional investment assets

Decentralized custody and asset control

Traditional centralized exchanges come with significant risks. In those systems, users must entrust their assets to a central custodian, exposing them to potential mismanagement and platform failure. The downfall of platforms like FTX highlights the risks inherent in centralized custody, where users have limited control over their assets.

Figure Markets tackles these risks by offering a self-custody approach. This model allows users to hold a 1:1 representation of their assets in their own wallets, with no central party controlling access or transactions. Control and security is augmented with the use of MPC technology.

What is MPC technology and how it enables decentralized custody

Multi-Party Computation (MPC) technology emerged in the early 1980’s as a method to enable multiple participants to compute a result without exposing their private data. In the context of digital assets, MPC has become a foundational technology for decentralized wallets and custodians to secure crypto assets. But how exactly does it work, and why is it crucial for investors who value asset security?

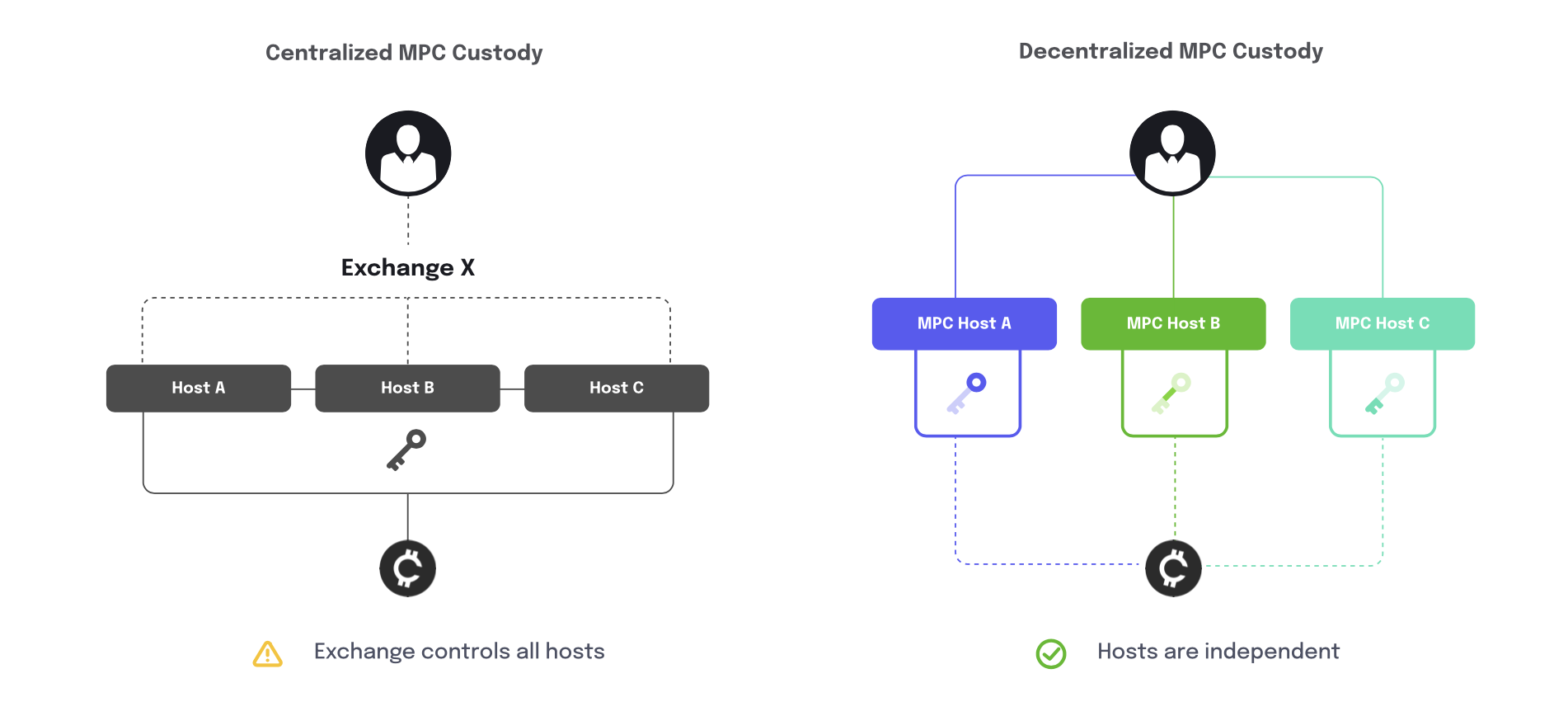

In technical terms, MPC technology is a cryptographic protocol that splits a private key into several fragments and distributes these key shares among MPC hosts. An MPC host can be understood as a secure and independent participant in the network that holds a portion of the key. For a transaction to be validated, these hosts must collaborate to combine their key shares, enabling the transaction without any one host ever having the full key.

To simplify, think of MPC technology as a form of team collaboration with a shared responsibility. Imagine a valuable asset locked behind a vault with multiple locks, each held by different trusted individuals called MPC hosts. Each host holds a part of the key, and no single host can open the vault alone. They must work together, each contributing their key part, to unlock the vault and access the asset inside. This collaborative effort means that no single individual has full control, which mitigates the risk of unauthorized access or misuse.

By implementing this system, Figure Markets enhances security, transparency, and trust; mitigating the risk of unauthorized access and limiting the vulnerabilities that are inherent in centralized control.

Forward Vault - Earn up to 8% on your stablecoins

Figure Markets stands out as a great alternative to traditional centralized exchanges, by offering not just decentralized custody but also daily-yield opportunities. Through the Forward Vault, eligible users can earn up to 8% APY* on their cash and stablecoins. This approach allows users to grow their crypto holdings in a smart, innovative, and liquid way.

Compared to traditional centralized exchanges, this model provides several key advantages:

- Competitive Returns: Figure Markets offers eligible users up to 8% APY on stablecoins, while major exchanges like Coinbase only provide around 4-6%** APY on stablecoins.

- Backed by Real-World Assets (RWA): Your interest in the Forward Vault is backed by RWAs, providing a stable and reliable source of returns. Unlike the yield opportunities of certain centralized exchanges, the Forward Vault is designed to generate real returns backed by real-world assets.

- Asset Control: Figure Markets utilizes a self-custody model. This approach gives users more autonomy over their holdings.

In short, the Figure Markets exchange offers traders and investors greater autonomy, optimized returns, and decentralized custody. By combining these strengths, it provides a more comprehensive alternative to traditional centralized exchanges.

Crypto-backed loans

In addition to the crypto exchange, Figure Markets also offers crypto-backed loans, enabling eligible users to borrow against their crypto holdings. This service provides access to liquidity without requiring users to sell their assets, allowing them to fund personal needs while maintaining their exposure to potential market gains.

Users can borrow up to 75% of the value of their ETH or BTC collateral through a straightforward process. After quickly setting up an account and getting loan approval, you deposit the collateral, and funds become available within a couple of days.

Figures Markets distinguishes itself by offering crypto-backed loans with competitive rates and flexible terms. Additionally, loan eligibility is based solely on crypto collateral, so no traditional credit score is needed.

Borrowers benefit from attractive interest rates and flexible payment options. You can explore how much you can borrow using BTC or ETH as collateral with the calculator on Figure Markets' crypto-backed loans page.

Figure Markets's future vision and next steps:

Expanding access with multi-asset trading

Looking ahead, Figure Markets is evolving into a versatile multi-asset trading platform. In addition to digital assets, the platform will expand to include traditional financial products such as stocks, bonds, and other assets. This will create a more inclusive trading experience where users can seamlessly manage a wider variety of assets.

By bringing together digital assets and traditional markets, Figure Markets is positioning itself as "the Exchange for Everything", offering greater flexibility and diversification for traders and investors.

Figure Markets Vision

Security remains a cornerstone of decentralized finance, and Figure Markets is committed to maintaining high standards of security through decentralized wallets powered by MPC Technology. As part of its broader vision, the platform is not only focused on safeguarding assets but also on becoming a hub for multi-asset trading, blending the best of TradFi and DeFi.

Are you ready?

Explore the possibilities that Figure Markets brings to the table. Sign up today to unlock new opportunities and confidently manage your financial future with Figure Markets!