Figure Markets on Markets - volume 1

May 2024 Recap

By Mike Abbate, Chief Investment Officer, and Jesse Yuan, Senior Research Analyst

June 17, 2024

Welcome to Figure Markets on the Markets, a newsletter where we provide commentary and insights on the ever-evolving world of traditional and decentralized financial markets. In this edition, we’ll explore the current state of BTC and ETH markets, updates on the latest developments at FTX, and recent regulatory and policy changes.

Key Takeaways

- BTC and ETH Strength

BTC nears all-time highs and ETH rallies - 20% in the days leading up to the SEC's potential approval of spot ETH ETFs in the US.

- FTX Updates

FTX's updated disclosure statement1 estimates $11.2bn of allowable claims with estimated customer recoveries to be between 119% and 143%.

- Regulatory and Policy

The Financial Innovation and Technology for the 21st Century Act("FIT21") aims to establish a regulatory framework for digital assets in the US, though it faces challenges in the Senate.

BTC and ETH Markets

BTC and ETH are holding just below their all-time highs following the SEC’s approval of eight 19-4b filings2 to list spot ETH ETFs on May 23rd, which triggered a ~20% rally in ETH price.

To better understand potential future ETH price action, we look at historical BTC price movement which rallied 54% in the five months since the spot BTC ETF began trading. Demand for spot BTC ETFs has been strong with net inflows of approximately $14bn (see Exhibit 1) since January 2024. Currently, these ETFs hold over $59bn or 835k BTC, representing nearly 8% of Bitcoin’s active supply3. This follows the April halving, which reduced BTC’s yearly supply from 328,500 to 164,250. The wrinkle worth noting when comparing BTC and ETH ETFs revolves around staking. Certain issuers such as Fidelity and Franklin Templeton have removed staking from the ETH ETFs due to regulatory pressures. Spot ETH ETFs that omit staking will have an increased opportunity cost of holding ETH through an ETF.

Exhibit 1: Spot Bitcoin ETF Flows4

| Ticker | Total Flows | June 3 AUM | Seed Capital |

|---|---|---|---|

| IBIT | $16,669.5 | $20,146.4 | $10.0 |

| FBTC | $8,977.4 | $11,418.2 | $20.0 |

| BITB | $1,984.2 | $2,555.5 | $200.0 |

| ARKB | $2,490 | $3,270.6 | $0.4 |

| BTCO | $318.2 | $504.8 | $5.1 |

| BRRR | $511.5 | $592.8 | $0.5 |

| EZBC | $362.0 | $424.9 | $2.6 |

| HODL | $524.1 | $691.9 | $72.5 |

| BTCW | $70.9 | $89.2 | $2.5 |

| GBTC | -$17,875.9 | $19,712.5 | $28,581.1 |

| Total Net Flow | $14,032.6 | $59,406.8 | $28,894.7 |

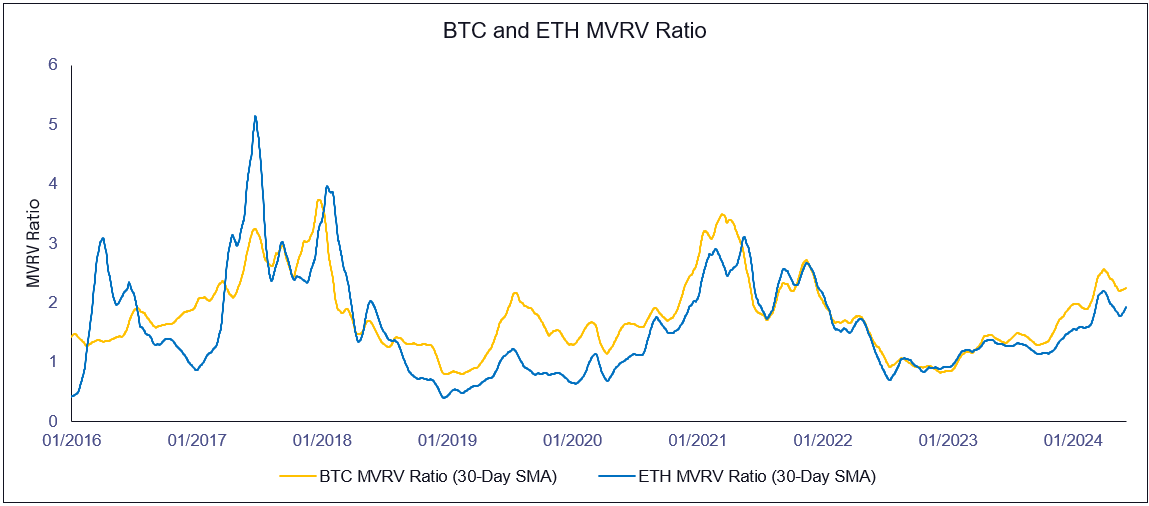

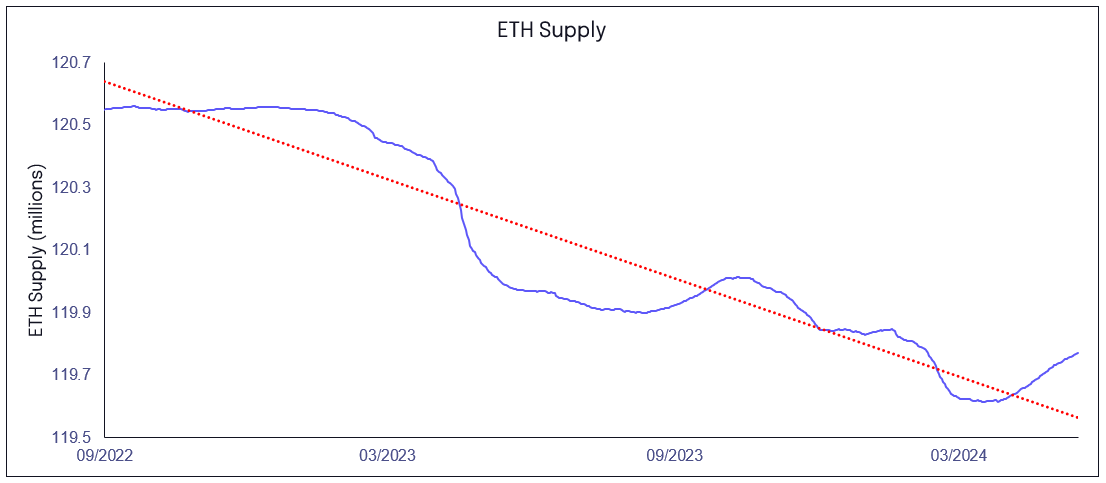

Are we at the end of the short term bull market or somewhere in the middle? The MVRV ratio would suggest the latter. Many traders look at what is called the MVRV ratio as an indication of bull and bear markets. MVRV measures the current market cap of a token over the last traded price of a token. Historically, buy signals exist when the ratio approaches one (not many people have trading gains to monetize), and sell signals appear when the ratio trends above three (an indication most people are buying the local highs). At the end of May 2024, MVRV for ETH was 2.125, pretty much smack in the middle of the historical buy / sell range. We believe that MVRV will continue to rise as spot ETFs purchases move tokens “off exchange” while token supply has generally been deflationary.

Exhibit 2: BTC and ETH MVRV6

Exhibit 3: Circulating ETH Supply7

FTX Claims

The FTX estate released its much anticipated Chapter 11 Plan with an expected effective date of 10/31/24. FTX holds nearly $9.9bn in cash and $1.4bn in digital assets (digital assets are marked at petition prices) as of 4/30/248. During the month, FTX received payments for their Anthropic sale of $884mm9. An additional $2.7bn in cash is expected to be received from the monetization of assets before the end of October, bringing the total estimated cash to ~$12.6bn. After the effective date, another $2.5bn to $4.3bn of assets are expected to be monetized for cash. In total, the estate expects to have $15.1bn to $16.9bn of net distributed assets. The estate currently estimates $11.2bn of allowable claims with estimated customer recoveries, after netting out priority claims, to be between 119% and 143% (see Exhibit 4) of their Petition Date claim values.

Exhibit 4: FTX Recoveries1

| Class | Estimated Percent Recovery |

|---|---|

| Class 5A/B: FTX.com & FTX.US Customer | 129% - 143% |

| Class 7A/B: FTX.com & FTX.US Convenience Class10 | 119% |

Despite these seemingly strong results, it is important to note that the claim values are calculated as of petition date prices (see Exhibit 5). Therefore, if a customer had one bitcoin on the platform at filing, his / her claim would only be for $16,871 dollars not for the $70,000 dollars where bitcoin is trading today.

Exhibit 5: FTX Petition Date Prices11

| Asset | Petition Price |

|---|---|

| BTC | $16,871.63 |

| ETH | $1,258.84 |

| SOL | $16.2471144 |

| USDT | $0.9975910 |

For example, a BTC denominated claim would need a 415% recovery for a creditor to receive a comparable amount of value back. A creditor that had SOL on the platform would need a 1,000% recovery to break even.

Customers should expect to wait until at least December of 2024 or early 2025 before they receive their claim distributions, subject to completion of KYC and necessary distribution information materials. Claims volumes and prices have continued to increase as customer demand for immediate liquidity on their claims rises and buyers feel more confidence in recoveries as the estate continues to monetize its assets.

Regulatory and Policy Updates

The SEC remains hawkish on the space and continues to regulate through enforcement. In May 2024, Robinhood received a Wells notice that the SEC had made a “preliminary determination” that Robinhood had violated securities law as an unregistered securities broker. The SEC made similar allegations concerning Coinbase’s activities. The complaint is expected to be filed in the coming months which will provide more details as to the merits of the SEC’s allegations and hopefully more clarity on which tokens the SEC thinks are securities and why.

Uniswap was also served a Wells notice alleging that the decentralized exchange (DEX) it is operating is an unregistered securities broker and unregistered exchange, and the UNI token is an investment contract. This is an important case to watch as Uniswap has already won a class action lawsuit where Judge Katherine Polk Failla ruled that Uniswap, by writing the code of the smart contract, was not a “seller” of tokens and thus not a financial intermediary.

Uniswap responded12 on 5/21/24 arguing the Protocol has facilitated over $2tn in transactions and offers significant consumer benefits by eliminating intermediaries, potentially saving American investors $12bn annually if adopted in traditional equity markets.

Amidst these regulatory actions, the recent passage of the Financial Innovation and Technology for the 21st Century Act (FIT21) by the House represents a significant legislative development in the digital assets sector. We expect FIT21 will bring stability and clarity to the digital assets ecosystem since it provides participants with a clear process to determine which digital asset transactions are subject to the SEC’s jurisdiction and the CFTC’s jurisdiction. Specifically, the CFTC will have jurisdiction over a digital asset as a commodity if the blockchain is functional and decentralized. The bill defines decentralization as: “if, among other requirements, no person has unilateral authority to control the blockchain or its usage, and no issuer or affiliated person has control of 20 percent or more of the digital asset or the voting power of the digital asset.”13

Despite the robust support from 71 Democrats, exceeding expectations, the bill faces considerable hurdles in the Senate. The lack of a Senate companion bill, a tight congressional schedule, and substantial opposition from key figures like Senate Banking Committee Chair Sherrod Brown, make its enactment this year unlikely. Although FIT21 is unlikely to be addressed in the Senate this year, it could lay the groundwork for future legislative efforts post-election.

Related Resources

Markets | Insights

Bitcoin, AI, and Housing - The Unexpected Connections You Need to Know

Continue reading

Markets | Insights

Political Shifts, FTX & CFTC Settlement, and Block’s ASIC Breakthrough. All You Need to Know.

Continue reading

Markets | Insights

Everything you need to know about Crypto Loans

Continue reading