Crypto Market Update: Navigating Volatility, Stablecoin Adoption & Solana's Rise

By Mike Abbate, Chief Investment Officer, and Jesse Yuan, Senior Research Analyst

August 15, 2024

Key Takeaways

- Buy the Flip

Crypto markets have experienced a sharp decline due to weak US economic data, raising fears of a global economic slowdown. Despite this, the fundamentals and adoption of crypto remain strong. Typically during periods of heightened economic uncertainty, the Federal Reserve will attempt to stabilize the economy by easing monetary policy, which tends to lead to an increase in crypto prices.

- Growing Stablecoin Adoption

Stablecoin transaction volumes in Q2 2024 was at $6.5T, up over 200% from Q2 20231. Stablecoins are not only gaining transaction volume but are also being integrated into major financial systems, as seen with Visa, Mastercard, and PayPal launching their own stablecoin initiatives2.

- SOL Flips ETH

Solana's DEX volumes surpassed those of Ethereum for the first time in July. The recent performance of SOL appears to be largely influenced by the Solana meme coin creator dApp, Pump.fun.

Buy the Flip

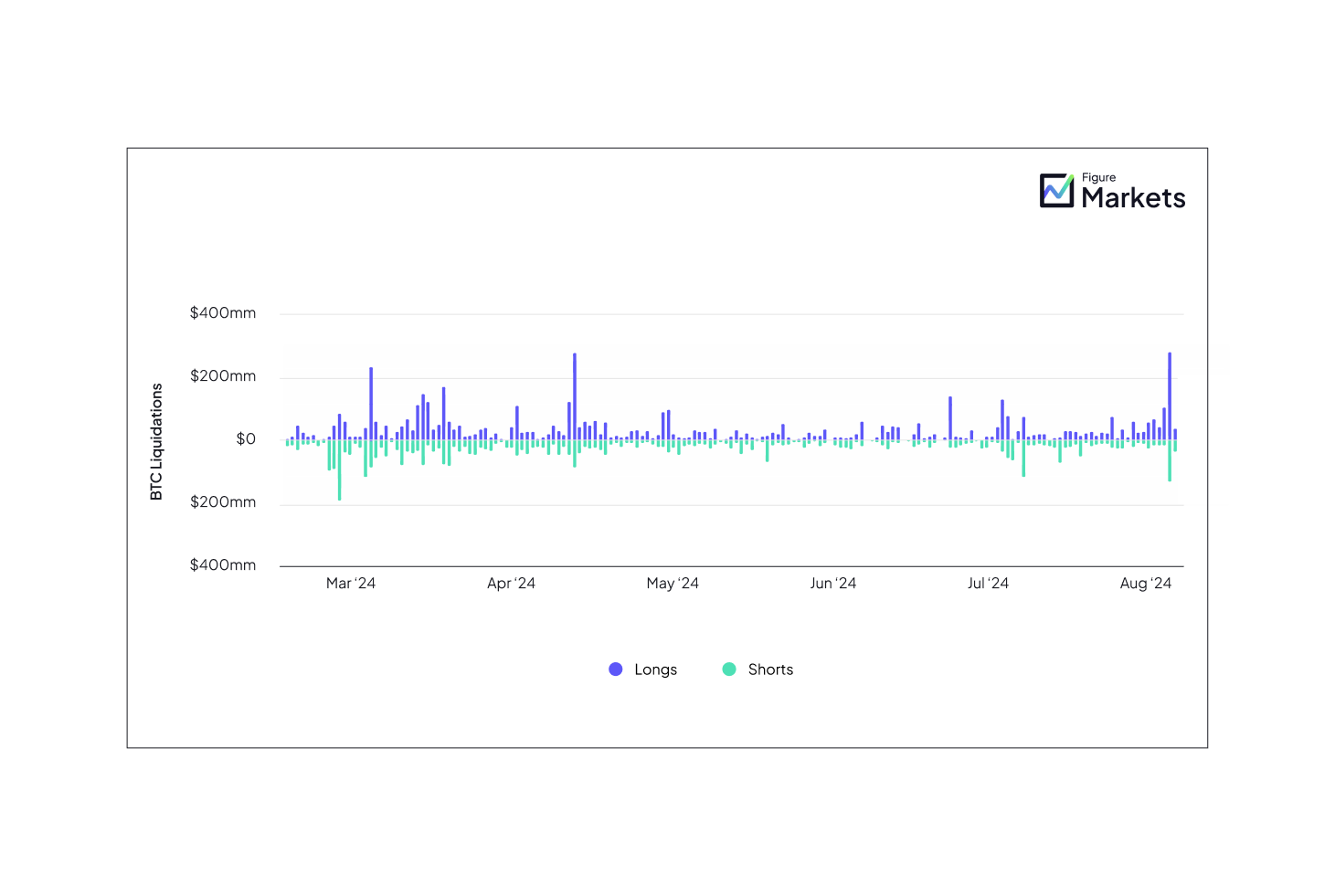

Crypto markets experienced a sharp sell-off this past week due to weak economic data from the US, igniting fears of a global economic slowdown. The slowing economy has prompted the Fed to ease, flipping its stance from fighting inflation to protecting growth and preventing a recession. The Fed Fund futures markets are already pricing in an aggressive response, with the implied probability of a 50 bps cut by the Fed’s September meeting now at 68%, a significant increase from just 12% the previous week3. Futures markets have now priced in an additional two rate cuts, bringing the total to five by January of next year4. As US rates declined, the rapid unwinding of the Yen carry trade led to a ~25% drop in Japanese markets on 8/5/24 from the Nikkei’s all-time high just 15 trading days earlier5. Heightened concerns over geopolitical risks in the Middle East exacerbated this situation. The VIX surged above 60 on 8/5/24, its highest level since March 2020 when it peaked at 85.47 during the Covid-19 pandemic6. As crowded trades began to unwind, the crypto market was not spared due to the negative convexity from exchange leverage. Crypto exchange position liquidations reached levels not seen since April of this year7.

Exhibit 1: BTC Exchange Liquidations8

However, as we have noted before, the fundamentals and adoption trends in crypto remain strong. When states began implementing shutdowns during the Covid-19 pandemic, BTC fell from ~$8,000 to $4,9009, wiping out roughly a year’s worth of gains in 24 hours. As global leaders stepped in to stabilize the economy - cutting interest rates and printing money - crypto markets began to rise. A year later, BTC was trading at $57,000, up more than 1,000%. Whenever the Fed goes into easing and money printing mode, we think it makes sense to buy the (Fed) Flip.

Further strengthening our long-term view on crypto markets is the continued demand of crypto ETFs. Spot BTC ETFs continue to shatter their daily net inflow records, totaling $17bn of net flows since launching in January10. Additionally, nine spot ETH ETFs officially began trading on 7/24/24. These ETFs experienced relatively weaker demand relative to the spot Bitcoin ETFs (~23%11 of volume) on its debut day. This is unsurprising given the lack of a staking element as discussed in previous commentary. That said, the nine spot ETH ETFs still traded over $1bn in volume10, some of which finished the day among the top 50 highest-trade U.S. ETF debuts of all time12.

Exhibit 2: Spot ETH ETF Flows10

| Ticker / Issuer | Total Flows Estimate ($mms) |

|---|---|

| ETHA / Blackrock | $760.6 |

| FETH / Fidelity | $312.9 |

| ETHW / Bitwise | $294.4 |

| CETH / 21Shares | $10.7 |

| QETH / Invesco and Galaxy | $14.3 |

| EZET / Franklin Resources | $31.5 |

| ETHV / VanEck | $67.7 |

| ETHE / Grayscale | -$2,161.6 |

| ETH / Grayscale (Mini) | $208.5 |

| Total Gross (Ex. ETHE) | $1,700.7 |

Growing Stablecoin Adoption

The global payments infrastructure is still dominated by traditional payment networks such as SWIFT and Visa, however these incumbents are facing increasing pressure as stablecoins gain regulatory traction (e.g., recent MiCA compliance achieved by Circle’s USDC and EURC in Europe). Traditional systems are burdened by high costs and slow processing times, especially for international transactions. Stablecoins offer lower transaction costs—ranging from 0.5% to 3.0%13 on average compared to the 6.4%14, 15 average for sending for international remittances via conventional channels—and faster settlements. Cross-border B2B transactions using stablecoins, while still small at $843mm in 2023, are projected to rise to $1.2bn in 202416, illustrating the growing adoption of stablecoins in real-world use cases. Stablecoin transaction volumes in Q2 2024 was at $6.5T, up over 200% from Q2 202317.

Stablecoins are not only gaining transaction volume but are also being integrated into major financial systems, as seen with Visa, Mastercard, and PayPal launching their own stablecoin initiatives. However, for stablecoins to achieve mainstream adoption, the industry must address regulatory challenges and build consumer trust. In the US, there are two bills currently outstanding in the House and Senate, respectively: the Clarity for Payment Stablecoins Act of 2023 (CPSA23) and the Lummis-Gillibrand Payment Stablecoin Act (LGPSA). We will surely keep you abreast of legislative developments.

Solana Flips Ether

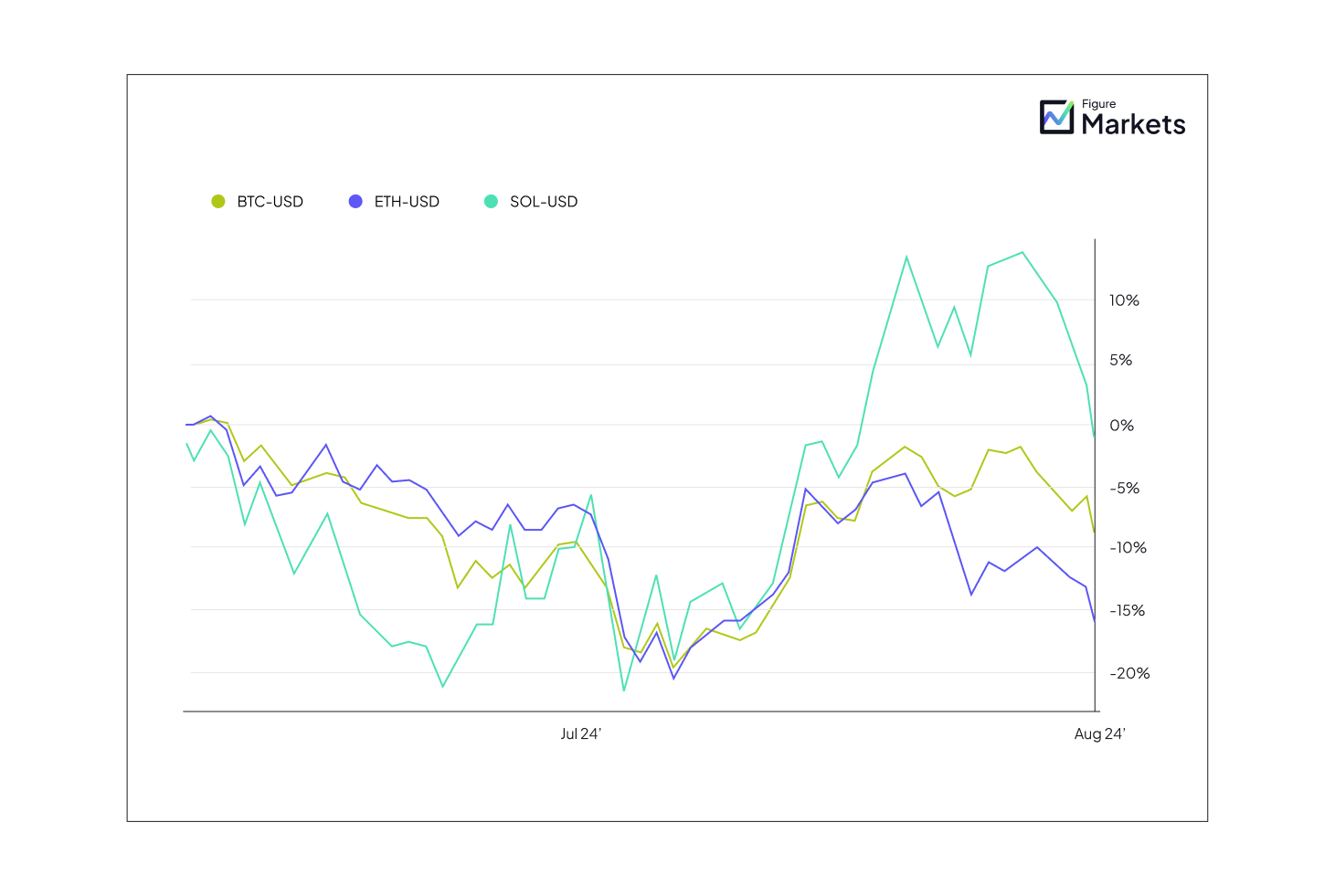

In July, SOL outperformed both BTC and ETH (see Exhibit 3 below), driven by a surge in decentralized exchange (DEX) volumes on Solana. Notably, Solana's monthly DEX volumes surpassed those of ETH for the first time in July.18

Exhibit 3: BTC / ETH / SOL Price Performance5

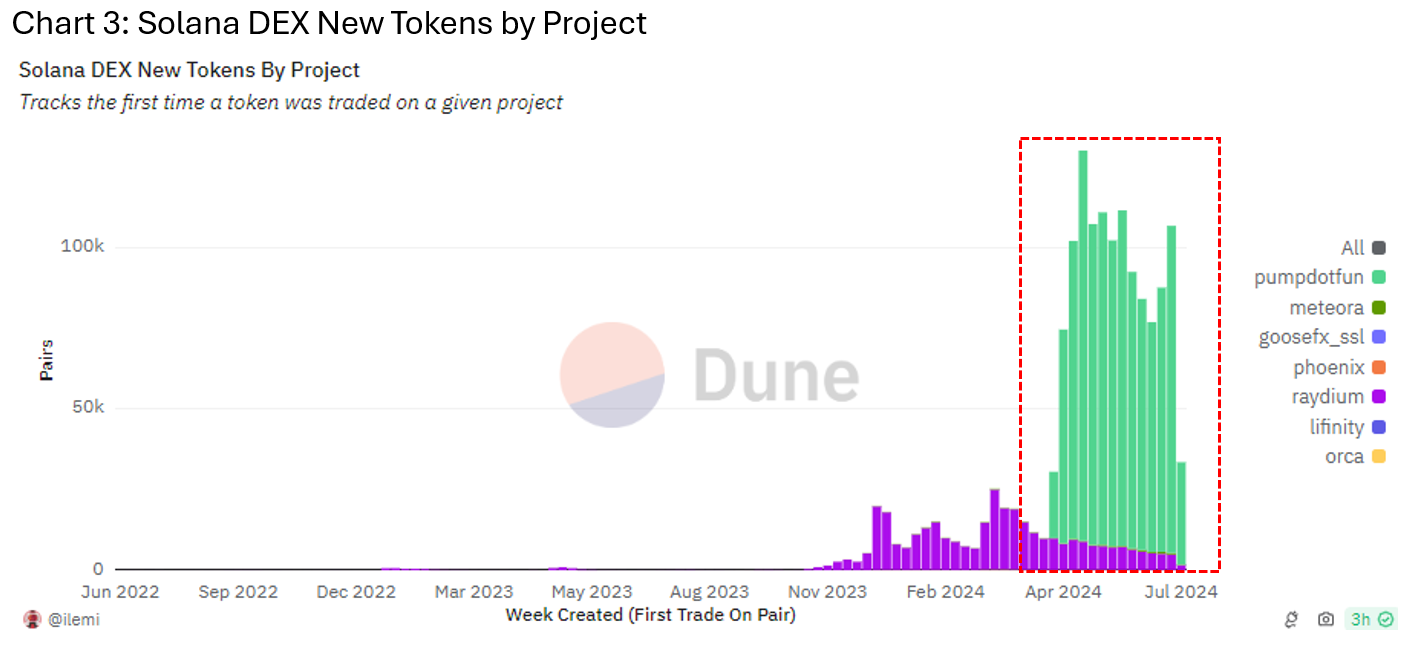

The recent performance of SOL appears to be largely influenced by the Solana meme coin creator dApp, Pump.fun, which launched in January 2024. Since then, over 90%+ (see Exhibit 4) of all new Solana token pairs have been memecoins created on Pump.fun.

Exhibit 4: Solana Dex New Tokens By Project19

Typically, as fundamentally driven value investors, we would snub our nose to such tomfoolery. However, the recent activity on-chain has led transaction fees on Solana to spike, causing validator yields to rise as high as 8%20 in July - a notable level compared to the background of nominal rates falling in the US. Combined with Van Eck filing for a Solana ETF, the once nearly defunct project, with FTX as its major backer, has gotten a second wind. Every flywheel needs a push to start spinning somehow…