Political Shifts, FTX & CFTC Settlement, and Block’s ASIC Breakthrough. All You Need to Know.

Delve into the market rally driven by political events, the significance of the proposed FTX-CFTC settlement, and Block, Inc.'s entry into the ASIC market.

By Mike Abbate, Chief Investment Officer, and Jesse Yuan, Senior Research Analyst

July 26, 2024

Key Takeaways

- Political tailwinds

Recent political developments have contributed to the latest rally in the markets.

- The FTX CFTC settlement is a win for creditors

On 7/12/2024, FTX and CFTC reached a settlement, marking a significant milestone in the ongoing FTX bankruptcy proceedings and customer recoveries.

- Regulatory and Policy

Block, Inc., the payments company, sold its first ASIC1 machine to customer Core Scientific. The agreement supplies Core Scientific with ~15 EH/s of hashrate, representing ~2.5%2 of the total Bitcoin Network (“Network”) hashrate.

Political Tailwinds

Since our last missive, we believe several political developments have contributed to a ~8%3 rally in BTC price. First and most important is the US Presidential election. A poor performance by President Biden in the first Presidential debate, followed by a failed assassination attempt on former President Trump, has led to a surge of Trump support. Trump’s polling average is at 42.3% compared to Biden’s 40.8%4 while Polymarket has Trump’s chance of winning at 72% against Biden’s 19%5. Endorsements from notable figures such as Elon Musk and Bill Ackman further support the “Trump Trade” in the markets, which consists of three pillars based on Trump's past term.

- More protectionist policies, which are decisively inflationary

- Increased spending / larger deficits and lower rates, i.e., fiat money debasement

- A more lenient / crypto-friendly regulatory environment

Confirming the “Trump Trade” as crypto-friendly was the announcement of JD Vance as the Vice Presidential candidate. Vance has disclosed more than $100,000 in Bitcoin holdings6, is circulating a draft Senate legislation that is reportedly more crypto-friendly than the House’s FIT217, and has opposed anti-crypto legislation in the past.

In addition, the Supreme Court’s recent reversal of what is commonly known as the Chevron deference bodes well for the crypto industry. The Chevron deference8 refers to case law from 1984, where the court ruled in a case involving Chevron (yes, the oil company) that government entities tasked with regulating an industry have broad power to interpret any ambiguity in the actual statues as opposed to having the courts clarify that ambiguity. Obviously the most ambiguous industry with respect to regulation has clearly been crypto and the SEC has been relying on this precedent to carry out much of its “regulation by enforcement” campaign. Finally, the long awaited ETH ETF launched on July 23rd. We have written about implications in past commentary which you can find here. Rally on!

FTX CFTC Settlement

We realize how ubiquitous FTX exposure was in the industry and how many of our readers were adversely affected. So we continue to report on the bankruptcy to better inform everyone no matter what their position is with respect to the case. We know that wading through a court docket with 20,000+ filings can be overwhelming, do not worry, here are our thoughts.

On 7/12/2024, FTX and CFTC reached a settlement, marking a significant milestone in the ongoing FTX bankruptcy proceedings. The CFTC was the largest and single most significant creditor of FTX with ~$52bn of claims for restitution, disgorgement and civil monetary penalties9. The estate’s recovery projections in its proposed Chapter 11 Plan (“Plan”) is predicated on a CFTC settlement with terms similar to those reached with the IRS. Without the settlement, customer recoveries would have been significantly impacted and limited to par plus accrued interest at the claim value at time of petition10 (you can check out our memo here describing how disingenuous a “par” recovery is vs. the rally in crypto). Under the settlement, the CFTC agreed to reduce its disgorgement claim to $4bn11 and, more importantly, provide any recoveries on this claim to US Customer Entitlement Claims, Dotcom Customer Entitlement Claims, Digital Asset Loan Claims, and Digital Markets Customer Entitlement Claims for supplemental payments (additional customer recoveries) via a Supplemental Remission Fund on a prorata basis. The CFTC settlement along with recent IRS settlement12 resolve the largest hurdles in achieving estimated customer recoveries per the Plan and is a major win for creditors. The settlement becomes effective only upon the confirmation of the Estate’s proposed Chapter 11 Plan. Important dates to note are 8/16/2024 (the voting deadline), 10/7/2024 (deadline for the court to approve the Plan), and 10/30/2024 (assumed effective date).

A new ASIC provider to the mining industry is just a chip off the Block

Block, Inc., the payments company leaning into Bitcoin, produced and sold its first ASIC13 machine to customer Core Scientific. The agreement supplies Core Scientific with ~15 EH/s of hashrate, representing ~2.5%14 of the total Bitcoin Network (“Network”) hashrate. The new machines will use 3nm chips, leapfrogging the competition that currently uses 5nm chips15, thanks to a partnership with a “leading foundry.”

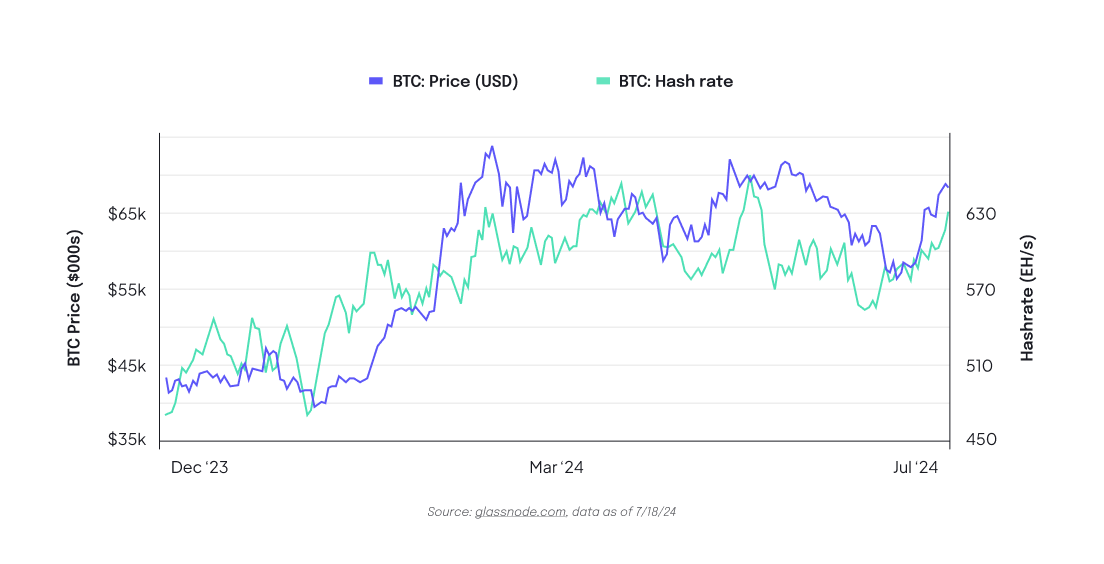

This development is significant not only because it introduces a new entrant into the ASIC market, adding to the competition and decentralization of the Network, but also because it is an American company leading the design. Currently, a very small number of Chinese companies (e.g, Bitmain, Whatsminer, etc.) have near or total control over the distribution of all hash power, a situation that would not sit well under a Trump administration (see above on tariffs). Overconcentration of hash power from a few manufacturers is also problematic for a network that is supposed to be decentralized. Risks could include ASICs potentially containing hidden malware and hardware bugs, among others. Additionally, without a competitive ASIC market, these few firms become price makers and wield undue influence on who has access to hash power. Miner fleets are constantly being upgraded to keep up with mining difficulty (hash rate is up 6x since 202116). Although we do not have the specs for the new miner, we assume it is more efficient than the outstanding fleet given its 3nm chip. More efficient miners being installed lead to higher hash rates and higher hash rates have historically had a strong correlation with price.

Exhibit 1: Bitcoin Network Hashrate vs. Bitcoin Price17

Now, if only NVIDIA would make an ASIC chip for BTC mining...