Crypto Market Update: Tailwinds Emerge, But Challenges Remain

By Mike Abbate, Chief Investment Officer, and Jesse Yuan, Senior Research Analyst

September 6, 2024

Key Takeaways

- Macro Tailwinds

We believe the macro environment is becoming increasingly favorable for crypto, driven by anticipated rate cuts and the upcoming election, where both presidential candidates have shown interest in establishing clearer crypto regulations.

- Bitcoin Transaction Fees

Over the past year, Bitcoin has seen a significant increase in transaction fees, driven by growing demand for block space due to new and emerging use cases. .

- FTX Updates

On 8/21/2024, FTX announced that the amended Plan of Reorganization has received overwhelming preliminary support from over 95% of creditors who voted, reportedly representing 99% of the claims by value.

- Ionic Digital

We believe Ionic Digital, the bitcoin mining company formed as a result of the Celsius bankruptcy, is facing significant challenges. Our Co-Founder and CEO, Mike Cagney, sent a letter to the two UCC members on Ionic’s board requesting a special meeting to discuss strategic paths forward.

Macro Tailwinds

On August 23rd, Jerome Powell declared that “the time for policy adjustment has arrived” at the central bank’s annual gathering in Jackson Hole, Wyoming, signaling the conclusion of the Fed’s historic inflation-fighting campaign. The Fed’s pivot comes as labor market data cools, with July’s unemployment hitting a three-year high of 4.3%1 and revised payroll figures showing 818,0002 fewer jobs added in the last 12 months through March. Investors were already expecting a rate cut by September given the drag current rates have had on economic activity, but markets still reacted positively. Following Powell’s remarks, crypto markets surged nearly 7%, with Bitcoin reaching $64,3003, as investors saw this as a signal to embrace risk-on assets. We believe the macro set up is becoming increasingly favorable for crypto, driven by anticipated rate cuts and an election year in which both presidential candidates, to varying degrees, have expressed interest in establishing clearer regulations for the crypto industry — a move that the US urgently needs.

Taking it a step further, Trump recently announced he wants Bitcoin to be “mined, minted, and made”4 in the US. Currently, US miners produce nearly 25%5 of Bitcoin, a figure we expect will rise as new facilities come online in the US. With 90%6 of Bitcoin mining machines made by China's Bitmain, we expect a Trump administration would likely impose tariffs on these machines. Some US miners have begun to hedge against geopolitical risk by sourcing ASICs domestically, as seen in the recent Core Scientific and Block deal. We discuss the implications at length in an earlier memo. In summary, the Bitcoin Network needs greater diversification in how it is secured to achieve true decentralization. We believe this is the step in the right direction.

Bitcoin Transaction Fees

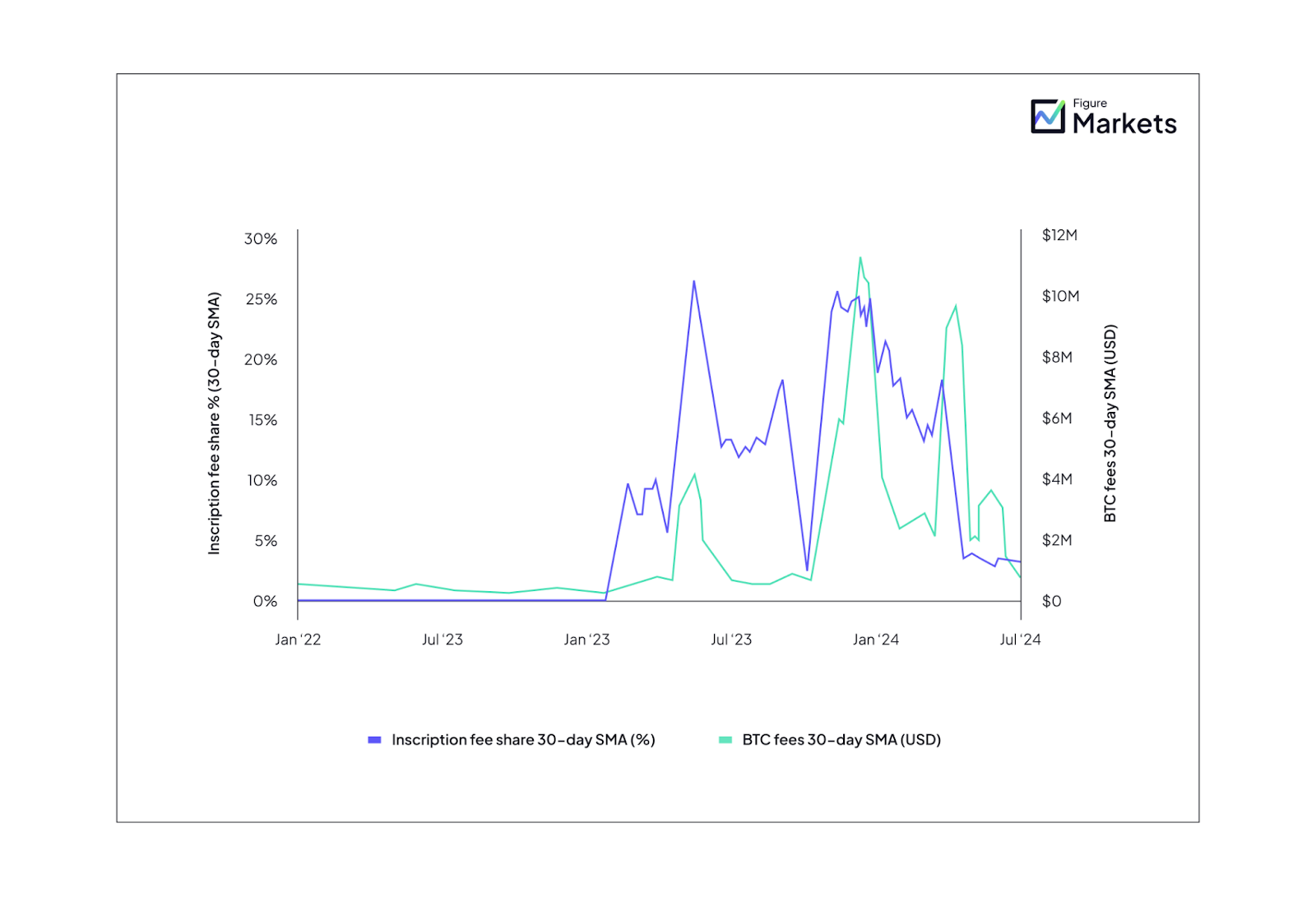

Over the past year, Bitcoin has seen a significant increase in transaction fees, which we believe is driven by growing demand for block space due to new and emerging use cases. In the 12 months through July 2024, users have paid approximately $1.3bn in transaction fees, compared to the $296mm in the year prior7. Adjusting for average BTC prices between the two periods, this equates to approximately a 115% increase in transaction fees8. Key protocol upgrades like the 2017 Segregated Witness (SegWit) and the 2021 Taproot update, have expanded Bitcoin’s capacity to handle more complex transactions. These updates have paved the way for new applications like Ordinals and Inscriptions, enabling users the ability to create NFTs by embedding data to specific satoshis9 (“sats”) on the Bitcoin blockchain. Ordinals create the "non-fungible" property for NFTs by utilizing a numbering system to order sats, while Inscriptions are the actual contents of the NFT, such as images, text, or other data. Since launching at the beginning of 2023, Inscription-related transactions have comprised of over 25% share of all BTC fees10 on certain days.

Exhibit 1: BTC Fees vs. Inscription Fee Share11

As developers keep pushing the boundaries of Bitcoin’s capabilities, we expect transaction activity and, ultimately, fees to continue rising. While there has been debate on the usefulness of Ordinals and Inscriptions, given the risk of "blockchain bloat," we believe it is important to recognize that these innovations could lead to use cases that drive broader adoption and utility for Bitcoin. We believe that the development of use cases beyond just a store of value is essential for Bitcoin's long-term security, particularly as block rewards, the primary incentive for miners, continue to halve every four years.

FTX Updates

On 8/21/2024, FTX announced that the amended Plan of Reorganization has received overwhelming preliminary support from over 95% of creditors who voted, reportedly representing 99% of eligible claims by value. The Plan is expected to exceed the required acceptance thresholds. Under the Plan, the estate estimates $11.2bn of allowable claims with estimated customer recoveries ranging from 119% to 143% of their Petition Date claim values, following the resolution of some of the largest governmental claims, as detailed in our earlier memo. FTX will submit the final voting results to the United States Bankruptcy Court for the District of Delaware before the Confirmation Hearing, scheduled to begin on 10/7/2024. We will keep our readers informed on any other relevant updates.

Ionic Digital

Ionic Digital is a Bitcoin mining company that was formed earlier this year to help generate additional recoveries for Celsius Network creditors through shares in a public Bitcoin mining company. $740mm12 of Celsius’s assets were transferred to Ionic to help jump start its operations, representing approximately 15% of creditors’ total recovery13. However, the company is currently facing several challenges14, including their CEO stepping down, their auditor resigning, and a poorly structured management agreement with a competitor, Hut 8, that is costing the company ~$15mm15 per year. Most concerning, however, is the Board’s recent decision to waive the Liquidity Deadline provision16 in the Hut 8 Management Services Agreement - a move we believe disadvantages shareholders by leaving them without a clear path to a listing on a National Securities Exchange (NSE) or Alternative Trading System (ATS).

Despite recent efforts, communication from Ionic to its creditor-turned-shareholders has been abysmal, raising accountability issues concerning the current leadership and board. In response, on August 13th, Figure Markets’s Co-Founder and CEO, Mike Cagney, sent a letter to the two UCC members on Ionic’s Board requesting a special meeting to discuss strategic paths forward. Unfortunately, the Board has been unresponsive and thus we are seeking to rally support from Ionic shareholders to force a special shareholder meeting to effectuate change for the benefit of shareholders. We believe that with adequate management and proper governance, there is a viable path to value creation for Ionic shareholders. Additionally, Figure Markets is prepared to facilitate providing a liquid market for Ionic shares, providing an exit strategy for shareholders wishing to sell.

To learn more about how you can support our efforts please visit: https://www.figuremarkets.com/letter-to-ionic-digital-shareholders/